Studies

DOM Development

DOM Development SA is Poland’s largest housebuilder with businesses in Warsaw, Gdansk and Wroclaw. With annual turnover of around £300m, Dom Development now builds and sells 4,000 homes each year.

Dom was founded in the mid-1990s by a team of entrepreneurs led by Yves Bonavero. They could see that Poland, emerging from the cold war, was in dire need of new and better housing stock to replace the poor-quality soviet-era accommodation. Dom was founded to meet that need. The company brought western European house-building quality standards into Poland and its homes became a byword for design and quality.

Dom floated on the Warsaw Stock Exchange in 2006 and has remained listed ever since, although the founding family retains significant control. It has built several tens of thousands of quality new homes in Poland is firmly established as the leading housebuilder in the country.

Woodsford Woning

Woodsford Woning is a real estate holding company specialising in residential real estate in the Amsterdam-Rotterdam area. In the aftermath of Brexit, the WW management team felt that the greater Amsterdam area could emerge as a major European beneficiary, as financial services firms in London migrated all or some of their activities onto the continent. On the basis that real estate demand would rise as a consequence, the WW team assembled a portfolio of individual properties, with funding support from local banks. Significant refurbishments were also undertaken to add value to the portfolio.

The portfolio is now rented out and will be held by the investors for the long-term.

Tradebridge

TradeBridge is a fintech lender headquartered in the UK with offices in France and Singapore. Founded in 2013 it has completed over $3bn of transactions to date and is growing strongly. TradeBridge designs and provides financing fit for a faster-moving world. Its mission is to help forward-thinking, entrepreneurial business leaders seize their growth opportunities, by providing a range of flexible working capital solutions. TradeBridge uses real-time data-enriched credit assessment tools to provide impactful new funding to its client. TradeBridge employs a multinational, multilingual team across its offices in London, Paris, and Singapore, specialising in technology, finance, and business development.

Woodsford Capital Management

WCM is a Singapore-based registered fund management company. Its principal activity is to manage the Woodsford Foundation Strategy, a systematic ETF investment strategy with c.US$150m AUM (at Jan 2021). WCM builds investment strategies around three core pillars: a long-term investment time-frame, keeping costs low, and a systematic approach to trading. Underpinning all three pillars is WCM’s evidentialist philosophy. In the worlds of British philosopher William Clifford, “It is wrong always, everywhere, and for anyone, to believe anything upon insufficient evidence.” Since its founding in 2009, WCM has applied this demanding and rigorous standard to all aspects of its investment management activities.

Woodsford Group

Founded in 2010, as Woodsford Litigation Funding now Woodsford Group is one of London’s oldest and most established commercial litigation funders as well as being a founder member of the Association of Litigation Funders.

WG was founded to help smaller enterprises facing the prospect of commercial litigation against deep-pocketed Fortune 500 defendants. By levelling the financial playing field, WG aims to improve access to justice. WG’s shareholders have committed more than $100m to support funding activities including both as equity and as a dedicated $75m funding facility. The business has a diversified, international portfolio of cases including international arbitration, high court litigation and intellectual property, while we also provide capital directly to support contingency law firms. WG currently has offices in London, Singapore and the United States, and employs a growing, multinational team of finance and legal professionals.

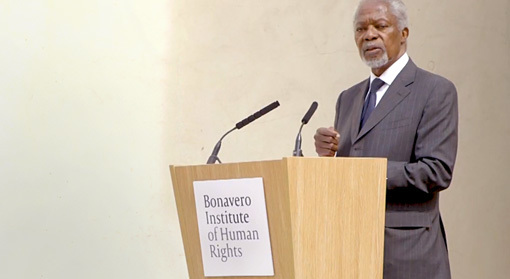

A B Charitable Trust

The A B Charitable Trust is an independent grant-making organisation, founded in 1990 by Yves and Anne Bonavero to champion human dignity and support marginalised and excluded groups. The Trust gives £7m each year and focuses on the priority areas of migrants and refugees; the justice system and penal reform; human rights and access to justice. The A B Charitable Trust is managed by a professional full-time staff, with additional business infrastructure support provided by Woodsford Consulting. For its 25th anniversary in 2015, the Trust made a gift to establish the Bonavero Institute of Human Rights at Oxford University.

Yves Bonavero

Chairman

Yves Bonavero was born and educated in Paris. He holds a First-Class Honours degree in Philosophy and German, as well as an MA, from Oxford University. Yves started his business career with Man Group and became CEO in 1987.

In 1996, Yves founded in Poland Dom Development, listed on the Warsaw Stock Exchange since 2006, which currently develops over 4,000 homes a year, and Europa Park, the country’s premier logistics and distribution centre. Yves is the chairman of Woodsford Consulting Ltd, which he founded in 1996. In 2010, he founded Woodsford Group Ltd which holds corporations to account for ESG breaches.

In 1990, together with his wife Anne, he established the A B Charitable Trust to promote human dignity and defend the human rights of marginalised and excluded people. The charity, which Yves chaired for thirty-three years, ranks among the UK’s top 50 grant making foundations and in 2015 endowed the Bonavero Institute of Human Rights at Oxford University.

Yves’s first novel, Something in the Sea, was published by Bloomsbury in 2006; his second, The Nuremberg Enigma, followed in 2016.

In September 2023, Yves was awarded by the Open University the honorary degree of Doctor of the University in recognition of his Public Services and the exceptional contribution he made to championing human dignity.

Philippe Bonavero

Director

Philippe’s professional background is as a barrister. He is a board member of several group -companies, as well as chair of the Grants Committee and Board of Directors of the A B Charitable Trust.

Jonathan Barnes

Director

Jonathan’s role combines his broad legal and business knowledge to understand, prioritise and provide ways to ensure Woodsford and its clients achieve their goals.

Thomas Porter

Managing Director

Thomas joined Woodsford in 2008 and is responsible for the day-to-day running of the company, as well as providing strategic and investment advice to clients. He sits on the boards of a number of group companies and is a CFA Charterholder.

Olivier Bonavero

Director

Olly has been an investment and financial services professional for over 20 years. At Woodsford, Olly’s role is to provide strategic advice to clients. He sits on the boards of a number of group companies and is the treasurer of the A B Charitable Trust.

Margaret Braksal

Group Accountant

Margaret has been a member of Woodsford team for many years. Initially involved in group operations in Poland, she is responsible for liaising with clients and service providers, to manage the preparation and review of financial statements for many group companies, in numerous jurisdictions. Margaret holds an ACCA Fellowship.

Szabina Popa

Consultant

Szabina joined Woodsford in January 2020, and her broad role involves looking after the Chairman and the Executives, organising events, and various project management roles across the group.

Duncan Spence

Financial Controller

Duncan joined Woodsford in 2019 and manages the accounts and controls for Woodsford Consulting along with several the larger group companies, including the AB Charitable Trust. Duncan qualified as a Chartered Accountant in 2014.

Minaxi Bhudia

Management Accountant

Minaxi has over 10 years’ experience in the finance sector. She joined Woodsford in October 2017 and has since been looking after the bookkeeping to management accounts, Payroll and HR for several group companies.

Kamila Serrano

Office Manager

Sophie Bonavero

Head of Real Estate

Having spent the past 25 years living and working in France and The Netherlands, Sophie has recently relocated to the UK, bringing an international touch to the team. Having structured and successfully managed a large residential property portfolio in The Netherlands, Sophie is responsible for advising Woodsford's clients on their real estate investments.

Jonathan Askham

Investment Finance Manager

Jonny joined Woodsford in October 2020. He carries out investment appraisals and provides financial reporting and analysis to a range of group companies, with a particular focus on real estate investments. Jonny is a Chartered Management Accountant.